The smart Trick of Hsmb Advisory Llc That Nobody is Talking About

The smart Trick of Hsmb Advisory Llc That Nobody is Talking About

Blog Article

Hsmb Advisory Llc Fundamentals Explained

Table of ContentsAll About Hsmb Advisory LlcSome Known Facts About Hsmb Advisory Llc.Indicators on Hsmb Advisory Llc You Should KnowIndicators on Hsmb Advisory Llc You Need To KnowThe Ultimate Guide To Hsmb Advisory LlcHsmb Advisory Llc - Truths

Ford states to guide clear of "money value or irreversible" life insurance policy, which is more of an investment than an insurance coverage. "Those are really complicated, come with high payments, and 9 out of 10 people do not need them. They're oversold because insurance agents make the biggest commissions on these," he says.

Disability insurance policy can be costly. And for those that decide for lasting treatment insurance coverage, this plan may make handicap insurance policy unneeded.

The Definitive Guide to Hsmb Advisory Llc

If you have a chronic wellness worry, this kind of insurance coverage might wind up being vital (Health Insurance). Do not allow it worry you or your bank account early in lifeit's typically best to take out a plan in your 50s or 60s with the anticipation that you will not be utilizing it up until your 70s or later.

If you're a small-business proprietor, take into consideration protecting your resources by acquiring business insurance policy. In the occasion of a disaster-related closure or period of rebuilding, organization insurance coverage can cover your revenue loss. Take into consideration if a substantial weather event affected your store or manufacturing facilityhow would that impact your revenue?

And also, utilizing insurance policy might occasionally cost greater than it saves over time. As an example, if you get a contribute your windscreen, you might take into consideration covering the repair service expense with your emergency savings as opposed to your vehicle insurance coverage. Why? Since using your automobile insurance can create your regular monthly costs to rise.

What Does Hsmb Advisory Llc Do?

Share these pointers to shield loved ones from being both underinsured and overinsuredand talk to a trusted expert when required. (https://www.pageorama.com/?p=hsmbadvisory)

Insurance policy that is purchased by a specific for single-person coverage or protection of a household. The specific pays the costs, instead of employer-based health and wellness insurance policy where the employer commonly pays a share of the costs. Individuals might look for and acquisition insurance policy from any kind of strategies readily available in the individual's geographic region.

People and families might get monetary aid to reduce the price of insurance coverage premiums and out-of-pocket prices, yet only when enrolling with Link for Wellness Colorado. If you experience specific changes in your life,, you are eligible for a 60-day time period where you can sign up in a specific plan, also if it is beyond the yearly open registration duration of Nov.

Hsmb Advisory Llc Things To Know Before You Buy

- Link for Wellness Colorado has a complete listing of these Qualifying Life Events. Reliant children who are under age 26 are qualified to be consisted of as member of the family under a moms and dad's protection.

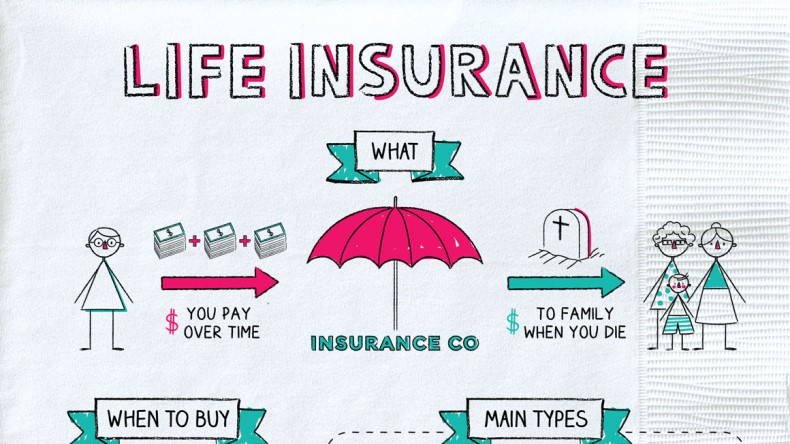

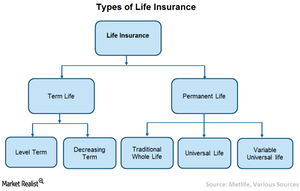

It may appear simple however comprehending insurance types can likewise be perplexing. Much of this confusion comes from the insurance industry's recurring goal to design personalized protection for policyholders. In designing adaptable plans, there are a range to select fromand every one of those insurance coverage types can make it hard to comprehend what a certain plan is and does.Excitement About Hsmb Advisory Llc

If you die throughout this duration, the person or individuals you have actually called as beneficiaries may obtain the money payment of the policy.

Nonetheless, numerous term life insurance policy policies let you convert them to a whole life insurance plan, so you don't lose insurance coverage. Normally, term life insurance plan premium repayments (what you pay each month or year into your policy) are not secured at the time of acquisition, so every 5 or 10 years you own the plan, your premiums can increase.

They likewise tend to be more affordable overall than entire life, unless you buy an entire life insurance policy plan when you're young. There are additionally a couple of variations on term life insurance policy. go One, called group term life insurance policy, prevails among insurance coverage choices you may have accessibility to through your company.Hsmb Advisory Llc Fundamentals Explained

One more variation that you might have accessibility to through your employer is additional life insurance coverage., or interment insuranceadditional insurance coverage that could assist your family in case something unforeseen takes place to you.

Irreversible life insurance policy merely refers to any type of life insurance policy plan that does not run out. There are a number of sorts of permanent life insurancethe most typical kinds being whole life insurance policy and universal life insurance policy. Entire life insurance policy is exactly what it seems like: life insurance coverage for your whole life that pays out to your beneficiaries when you die.

Report this page